The biotechnology industry has seen remarkable growth and progress over the past few years, with numerous startups making a big impact. We have seen the contributions made during the COVID pandemic, where vaccines and COVID treatments developed by biotech companies had a monumental impact on global health. Furthermore we have seen advancement in areas like cell and gene therapy, neurology, and precision oncology, and more.

With Venture Capital (VC) investments financing innovative therapies that address unmet needs, the biotech industry will make lasting changes that can help overcome some of the societal healthcare challenges. We all hope that in the future, biopharma may be able to not only treat but also cure more common diseases and prevent others, as well as making access to better treatments available for larger group of patients.

However, the long-term future of our biotech industry can only be guaranteed if we manage to replenish the scene with new players bringing along novel ideas and approaches. Over the last years we have lived through an exceptional sequence of socio-economic shocks, with the coronavirus pandemic, the supply chain crisis, and the ongoing Russian invasion of Ukraine. These events compelled us to look under the hood of European biotech and ascertain whether the motor of innovation is still running.

Company creation has stalled

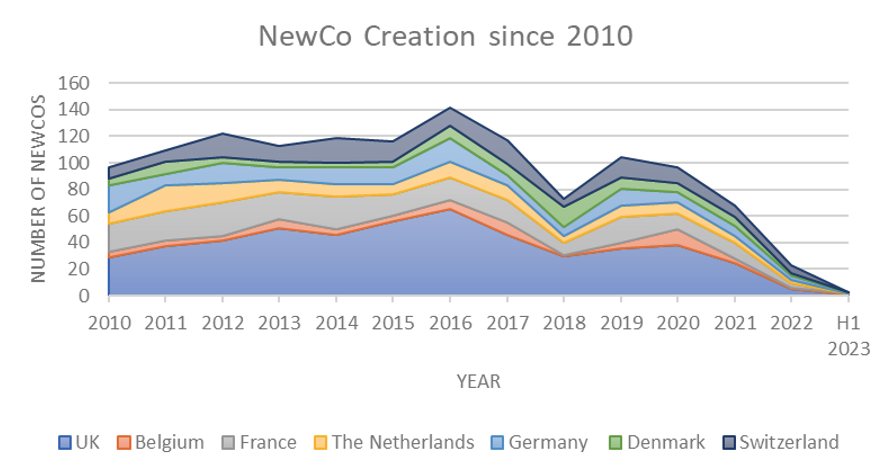

In order to investigate the matter objectively, we took a deeper look at the data on the number of new companies (NewCos) that were established of the past years in some of the key European biotech hubs. The data were extracted from BCIQ (a biotech business intelligence database curated by BioCentury) by querying for companies founded in a specific year.

Figure: New company (NewCo) creation in European biotech hubs 2010 – 2023 (V-Bio proprietary data, generated using Biocentury BCIQ, 18 July 2023)

The data on NewCo creation in the larger European Biotech hubs (Belgium, France, The Netherlands, Germany, Denmark, Switzerland, and the UK) show a slight increase in the number of biotech companies founded every year during from 2010 to 2016. However, from 2017 NewCo creation is clearly trending downwards. There was a dip in 2018 at the start of the bear market in stocks, whereafter NewCo creation picked up again in 2019 and 2020. Admittingly the numbers didn’t reach the highs of the years preceding the crash, but considering the ongoing pandemic and country-wide lockdowns it all still looked hopeful.

And yet, hope seems to have foundered since then: looking at NewCo creation over the past two years, we should speak of a standstill rather than a slowdown. We are looking forward to seeing the end-of-year data for 2023, which might brighten the picture a little bit. Currently, it seems the motor of NewCo creation in Europe has stalled.

Less power for early-stage startups

This current dearth in NewCo creation in key European biotech hubs will have a knock-on effect over the coming years. Every time a NewCo is created it further enables the development of a technology or product which otherwise was not possible, whether at the academic research institute or the parent pharma company. As fewer biotech startups are being founded, there will likely be a decrease in the number of innovative treatments eventually reaching patients in need.

The shortage in early-stage startups will also have an impact on VCs, particularly regarding the larger pots of money now available in the European ecosystem. With fewer early-stage investment opportunities, there won’t be as many companies making it through to the Series B and C financing rounds which are sought after by the larger VC funds. Over the past years more funding has been poured into the European biotech sector, with many of the VC powerhouses creating record size successor funds in ever shorter cycles. These unprecedented fund sizes require a faster turnaround of money, which will have repercussions on the type of deals that these large funds are pursuing.

“We need watering cans, sprinklers and hoses that are appropriate to the size and scale of the companies we are growing.” – Steve Bates

With initial investment stakes of EUR 20-25 million, it will be a challenge to prioritize funding for early-stage startups and academic spin-offs which have high intrinsic attrition risks. Hence, we will likely see a tendency of the larger funds to favor later-stage investments in companies that have already identified drug candidates and are close to, or already in, clinical development.

Fueling all parts of the machine

A diversified approach to capital allocation is fundamental to ensuring the growth of the innovation sector. This thought was exemplified by Steve Bates (CEO of BIA), when he said: “We need watering cans, sprinklers and hoses that are appropriate to the size and scale of the companies we are growing.”

Should startups “fake it till they make it” or is it better to be honest with potential investors? Read this article for the VC perspective on fact vs. fiction!

To build and maintain a vibrant biotech ecosystem, we need more than just larger investors investing into companies with identified therapeutic candidates. Equally important are knowledgeable investors that can roll up their sleeves and engage with entrepreneurs and research institutes to create fledgling companies, putting them into the best position for future growth and follow up financing by larger investment funds.

Dedicated early-stage life sciences investors – such as V-Bio Ventures, BioGeneration Ventures, Thuja Capital, Kurma Capital, and university seed funds – are an essential part of the ecosystem. If they can be combined with governmental initiatives supporting the high-risk initial steps of translating innovative science into products, the fundament underneath the biotech ecosystem can be preserved and strengthened.

As always, progress comes down to people: these funds need to have investment professionals with long standing expertise and network in the sector and the guts to give new inventions the chance to thrive. There are challenging yet exciting times ahead for investment managers if they are able to seize the opportunity and crank the engine of European biotech innovation.